Continuing a trend that dates back to 2015, Harley-Davidson again sold fewer motorcycles in the third quarter. Yet the company reported an increased profit and the stock jumped, rising more than 25 percent at one point in the day after the quarterly results were announced.

So what’s happening here? Has Harley-Davidson really improved its situation? Or is it possible the new CEO is just buffing and polishing the numbers, possibly with the idea that the company will be sold?

Since Jochen Zeitz replaced former CEO Matt Levatich earlier this year, he has reversed the company’s strategy. Where Levatich was focused on global expansion and adding new models, Zeitz has put the focus back on the domestic market and cutting costs. Where Levatich a few years ago promised Harley-Davidson would be introducing 100 new models, a major part of Zeitz’s plans is reducing the number of models Harley offers by 30 percent. The company is also pulling out of many international markets where sales numbers were small and not many consumers could afford to buy expensive Harleys.

While Harley-Davidson is continuing with plans to enter a new market with the Pan America adventure-touring motorcycle, the company has dropped plans for the Bronx street bike. Jochen Zeitz has seriously scaled back the expansion plans for former CEO Matt Levatich.

Still, Harley-Davidson’s 38.9 percent increase in net income for the third quarter came as a surprise to most. At first glance, it’s hard to see how the company showed a surprise profit. Total revenue was down 8.4 percent for the quarter. Retail motorcycle sales fell 8.1 percent worldwide and 10.3 percent in the United States. Adding to the headwinds, Harley-Davidson sold fewer expensive touring bikes and more of the less expensive Sportster and Street models.

At least for one day, investors cheered the surprise earnings beat by Harley-Davidson.

So where did the profits come from? For one, cost-cutting, as Harley-Davidson has laid off both factory and white-collar employees. But the other factor is the positive contribution of Harley-Davidson Financial Services.

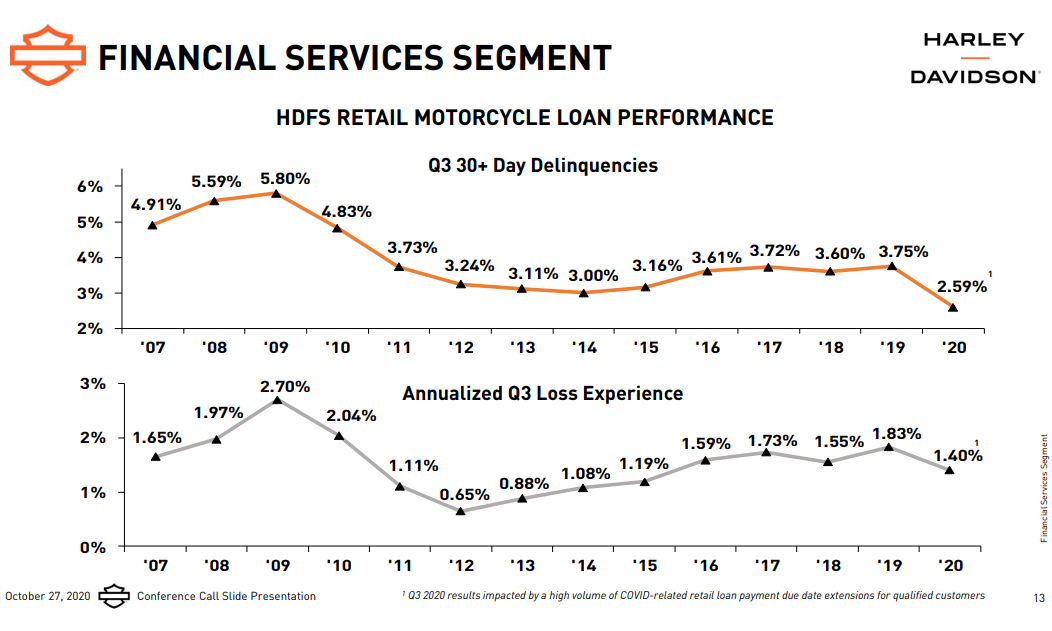

With unemployment up, you might think HDFS, which provides the loans many customers use to buy new or used Harley-Davidsons from dealers, would be suffering. Take a look at this chart, however, which shows that loan delinquencies are lower than they’ve been in years, despite high unemployment and layoffs. How can that be?

Loan delinquencies are at multi-year lows because borrowers who have been given forbearance due to COVID-19 related hardships are not counted as delinquent.

It’s simple once you understand that Harley-Davidson, like many companies, is making special allowances for customers who have been affected by the COVID-19 pandemic. If you took out a loan late in 2019 to buy a new $18,000 motorcycle and lost your job in April, you can ask Harley-Davidson for forbearance and stop making payments. And if you do that, even though you fall behind in your payments, Harley-Davidson does not count your loan as delinquent. And that’s why loan delinquencies are so low.

In addition to that, one reason Harley-Davidson was able to show that surprise profit in the third quarter is that it did not set aside the large amounts for loan losses that it did earlier in the year.

Is any of this sustainable? Whether the people who can’t pay their loans are counted as delinquent or not, sooner or later HDFS has to either get payments or repossess the bikes.

Zeitz says the positive third-quarter financial numbers are evidence of the turnaround he has engineered. The company has reduced inventory (which was easy to do, with factories shut down for a while earlier this year), which has kept selling prices high in dealerships for both new and used motorcycles. And that’s his strategy: not to sell more bikes but to sell them at higher prices while producing fewer models and options to keep costs down. “Desirability” is the word Zeitz uses over and over, claiming that the real goal is to “solidify our place as the most desirable motorcycle brand in the world.”

Some believe there’s another strategy behind the scenes. The buffing and polishing of the financials in a way that looks good in the short term but may not be sustainable in the long term is a tactic often used by the executive team in companies that are looking for a buyer. Having abandoned the previous strategy of global growth and entering new market segments, Harley-Davidson faces a future of becoming a smaller company, selling fewer motorcycles at premium prices to a core customer base that is aging and shrinking.

Maybe it can do that better as a subsidiary of a larger company. That may not be the main strategy, but it has to be an option on the table. And sprucing up the financials, if only in the short term, is a typical part of that plan.

Yeah, the proof of this new strategy will be in subsequent quarters. Shake and bake works when you need a quick hit to improve your immediate financials; let’s see how it plays out a year or two from now. However, I will say that it makes good sense to see them exiting low volume markets, where the cost to compete was literally more than what they were making off the bikes sold. Competing just for the sake of competing seldom makes good financial sense – if you are not number one, or a close second in your chosen segment, it’s better to exit and redeploy those resources elsewhere

I tend to agree that pulling out of some small international markets makes sense. The MoCo will now do business directly in 36 markets. When Harley-Davidson announced earlier this year it was pulling out of India, that got a lot of news attention, because India is the world’s largest motorcycle market. But less attention was paid when Harley announced this past week it was partnering with Hero as a distributor in India. So the few well off customers in India who want an expensive Harley-Davidson will still be able to get one. India will be one of 17 countries where Harleys are sold through a distributor agreement.